Martingale

What is the Martingale strategy?

The idea of the Martingale strategy is to counteract the losses caused by lost trades. In standard Martingale, if you lose a trade, you re-enter with a greater trade amount, so that over time, a winning trade will compensate all the previous losses. This new trade amount is equivalent to the amount of the lost trade multiplied by a Martingale coefficient. It should be noted that Martingale strategy can be risky, so you will have to be very careful when setting it up.

Configuration from the MetaTrader Auto Connector and Manual Connector

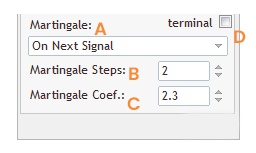

The Martingale section is composed of three parameters By default, the martingale strategy is turned off.

A. Martingale

It’s time to choose which type of Martingale you are going to use. If you open the menu where by default “No Martingale” is selected, you’ll get seven different Martingale options to choose.

First of all, you must distinguish two different strategy types: Martingale and Anti-Martingale.

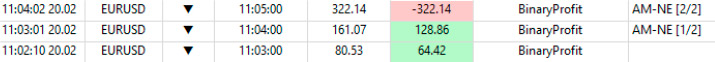

- Martingale: This is the standard Martingale strategy. It applies to lost trades. Once you lose an operation, a new trade will be opened with a greater trade amount (equivalent to the lost trade amount multiplied by a martingale coefficient)

- Anti-Martingale: Unlike the standard Martingale, the strategy applies to the won trades. If you win an operation, a new trade will be opened with a greater trade amount.

NOTE: It is suggested that for Anti-Martingale, the coefficient is less than one. Otherwise, you would lose what you’ve gained.

Once you have decided the Martingale strategy to use, it’s time to decide when to apply it.

There are two possible options:

- “On next expiry”: Martingale will be applied immediately after the current trade closes on the same currency pair.

- “On next signal”: Martingale will be applied on the next signal. You can either choose to apply it on the same currency pair or any.

If you choose to execute Martingale “On next signal”, you will find that there are two possible options:

- “On next signal (Connector)”: Martingale will only be applied on the next signal of the same currency pair.

For example: If you lose a USDCHF trade and our Martingale is configured on ‘Connector’, it will be applied only when a USDCHF signal comes.

- “On next signal (Terminal)”: If you choose this option, Martingale will be applied on the next signal of any of the pairs configured on ‘Terminal’.

For example: Suppose you’ve configured USDCHF, EURUSD & AUDUSD pairs on ‘Terminal’, and lose a trade in one of these pairs. Martingale will be applied on the next received signal from any of the pairs configured on ‘Terminal’ (in this example USDCHF, EURUSD & AUDUSD). If you lose a EURUSD trade, the Martingale step can be executed only in USDCHF, EURUSD or AUDUSD.

B. Martingale steps

This parameter defines the number of Martingale steps. If you lose a trade, the first Martingale step will be applied. It will multiply the previous trade amount by the chosen coefficient. In case you lose the first Martingale step, the second step will be applied. If you keep losing, it will keep applying the Martingale strategy until reaching the maximum number of steps you’ve set. If the last step is reached and the trade is lost, the Martingale step counter will reset to zero.

You can use as many steps as you wish, but remember that the greater the number of steps, the greater the risk.

C. Martingale coefficient

This is the number that will multiply your trade amount on each Martingale step. For each new Martingale step executed, a new trade amount will be calculated (previous step trade amount multiplied by the chosen coefficient)

In the example above, if the trade with an amount of $2 USD results in loss and your Martingale coefficient is 2, it will multiply $2 USD x 2 and the next step of Martingale will be $4 USD.

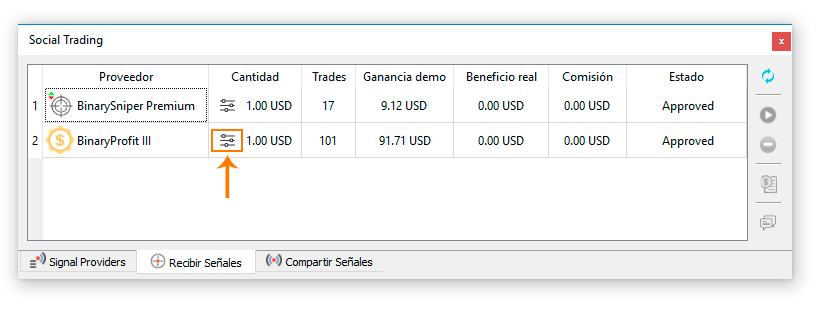

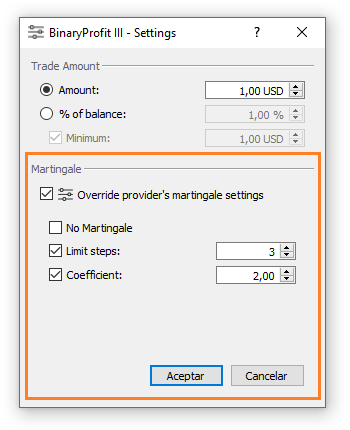

Override signal provider’s Martingale Strategy

What can I do if my Copytrading provider’s Martingale strategy does not convince me? Just override your providers settings and configure your own

This window will be automatically opened when you send a subscription request to a signal provider.

Once in this window, just follow these steps:

- Check “Override provider’s Martingale settings”.

- Define and set the number of Martingale steps.

- Set the Martingale coefficient.

In case you want to deactivate the provider’s Martingale, check the “No Martingale” option.

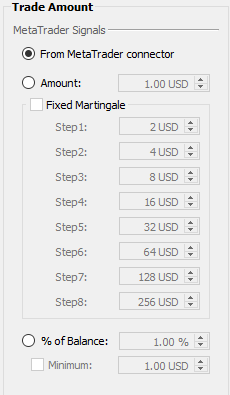

Fixed Martingale for MetaTrader signals

From the “Configuration” section of MT2 you’ll be able to customize the amount of each Martingale step, without having to use always the same coefficient.

Inside the ‘Configuration’ section we are allowed to set different Martingale coefficients for each step.

Check the ‘Amount’ parameter, where we will adjust the trade amount without Martingale.

The ‘Fixed Martingale’ option will be automatically activated. Set the fixed amount of each of the 7 steps of Martingale to personal need.